The Biden-Harris Administration is reducing health care costs, expanding access to coverage, and ensuring nearly everyone who buys their own individual or family health insurance through a Marketplace can receive a tax credit to reduce their premiums. The American Rescue Plan (ARP) not only provides the resources for America to beat this pandemic, but it also expands access to health insurance coverage, lowers costs, and ensures that health care truly is a right for all Americans.

- It’s Working: After the Biden-Harris Administration made available a Special Enrollment Period through the Federal Marketplace from February 15 to May 15 for people who needed health care coverage during the pandemic, more than 200,000 people signed up for Marketplace coverage through HealthCare.gov in the first two weeks - a three-fold year over year increase. Now following the passage of the ARP more than 14.9 million Americans who currently lack health insurance and many current enrollees will receive additional financial support to find the coverage that best meets their needs at a price they can afford.

- More Affordable Options are Available: Many people who enroll in health coverage through HealthCare.gov will qualify to save money on their premiums. Premiums after advance payment of these increased tax credits will decrease, on average, by $50 per person per month and $85 per policy per month. Four out of five enrollees (up from 69% pre-ARP) will be able to find a plan for $10 or less per month after tax credits, and over 50% (up from 14% pre-ARP) will be able to find a Silver plan for $10 or less per month.

- Making it Easier for Consumers: Starting on April 1, consumers will be able to take advantage of increased premium tax credits on high quality health care plans when they enroll in coverage through HealthCare.gov. Every day, we’re working to make the consumer experience even better, streamlining HealthCare.gov and providing the help and support consumers want in order to understand their options and pick the right plan for their families.

The American Rescue Plan:

Reduces the cost of health care coverage for 9 million consumers currently receiving financial assistance by ensuring consumers eligible for premium tax credits have at least a couple plans to choose from that won’t cost more than 8.5% of their household income on their Marketplace plan premium per year.

- Many premiums will decrease, on average, by $50 per person per month and $85 per policy per month.

- Four out of five enrollees (up from 69% pre-ARP) will be able find a plan for $10 or less per month after tax credits, and over 50% (up from 14% pre-ARP) will be able to find a Silver plan for $10 or less per month.

- 1 out of 4 enrollees on Heathcare.gov will be able to upgrade to a higher plan category that offers better out of pocket costs at the same or lower premium compared to what they’re paying today (excludes enrollees already at the highest health plan category available, including certain enrollees eligible for cost sharing reductions).

- For example:

- Uninsured couples earning over $70,000 could save more than$1,000 per month on their monthly premium.

- A family of four making $90,000 will see their premiums decrease by $200 per month.

- An individual making $19,000 will be able to find health insurance coverage with no monthly premium, saving roughly $66 per month on average.

Expands the number of people eligible to save money on their health care coverage.

About 14.9 million Americans who currently lack health insurance will be able to save money on their premiums to find the coverage they need at a price they can afford:

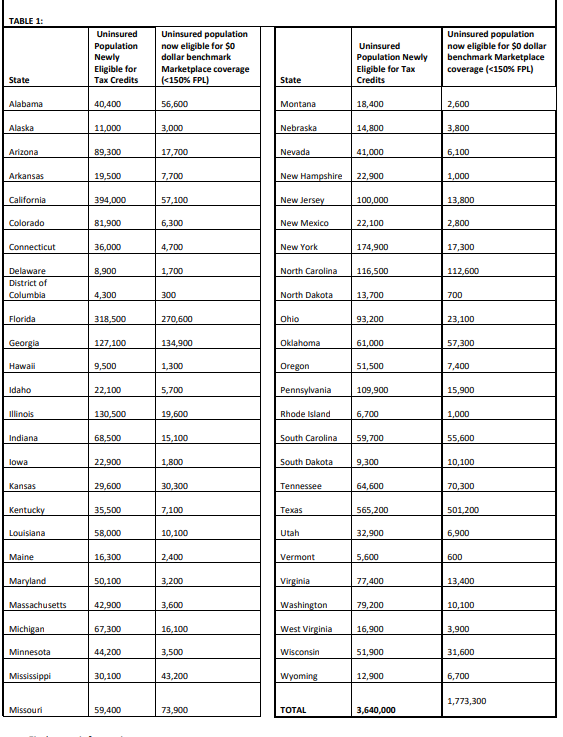

- 3.6 million uninsured people are estimated to be newly eligible for health care coverage savings.(See state level data in table 1)

- 1.8 million uninsured people are estimated to be eligible for zero-dollar benchmark Marketplace coverage, since PTC-eligible individuals with incomes below 150% of the FPL will now qualify for a 100% premium subsidy for the benchmark Marketplace plan. (See state level data in table 1.) Millions more are eligible for zero-dollar coverage for non-benchmark plans.

- An additional 9.5 million uninsured people with incomes between 150% and 400% of the FPL are estimated to potentially qualify for additional financial support to reduce out-of-pocket costs for Marketplace premiums.

Addresses racial health inequities by expanding coverage and reducing costs. Increased affordability and health insurance coverage expansion will allow historically uninsured communities – especially those who have faced significant health disparities – to access coverage, thereby improving opportunities for health care during and beyond the COVID-19 pandemic.

- The COVID-19 pandemic has exacerbated stark health disparities among certain racial and ethnic minority populations in several areas, including infections, hospitalizations, death rates, and vaccination rates. Many of these same populations have experienced job loss or loss of health insurance coverage at disproportionally high rates.

- 48,000 uninsured American Indians and Alaska Natives will be newly eligible to save money on health care coverage and 21,000 will be eligible for zero-dollar benchmark Marketplace plans.

- 730,000 uninsured Latinos will be newly eligible to save money on health care coverage and 580,000 will be eligible for zero-dollar benchmark Marketplace plans.

- 360,000 uninsured Black and African Americans will be newly eligible to save money on health care coverage and328,000 will be eligible for zero-dollar benchmark Marketplace plans.

- 197,000 uninsured Asian, Native-Hawaiian and Pacific Islander will be newly eligible to save money on health care coverage, and 50,000 will be eligible for zero-dollar benchmark Marketplace plans.

- The Biden-Harris administration is further expanding access to health insurance coverage and improving access to mental health services and community-based programs that address social determinants of health.

Comments

0 comments

Please sign in to leave a comment.